KITCHENER'S 2024 BUDGET

KITCHENER'S 2024 BUDGET WAS FINALIZED ON THURSDAY DECEMBER 14

For the average home in Kitchener, the rate increases for 2024 are:

- Property Taxes: 3.9 per cent, or $47 annually

- Water Utility: 4.9 per cent, or $21 annually

- Sanitary Sewer Utility: 7.1 per cent, or $39 annually

- Stormwater Utility: 7.4 per cent, or $17 annually

- $400k for additional traffic calming and trail connections in neighbourhoods

- $200k to develop an arena energy strategy as part of the city’s Corporate Climate Action Plan 2.0

- $300k to move forward with two additional playgrounds replacements

- $200k to develop a Municipal Newcomers Strategy, including community engagement

- $300k to improve access and increase usage at Cameron Heights Pool

- $200k for the implementation of a city-wide data strategy to build organization-wide data practices to deliver better services for residents

- Rosenberg Community Centre ($2.9M in 2024)

- Mill Courtland Community Centre ($2M in 2024)

- Downtown Fire Hall ($7.3M in 2024-2025)

- Full Road Reconstruction Projects ($40M in 2024)

- Upper Hidden Valley Sewage Pumping Station ($19M in 2024)

- Cycling Infrastructure ($700k in 2024, $7.6M overall)

- Traffic Calming ($424k in 2024, $4.6M overall)

- Aquatics Centre at Schlegel Park ($56M in 2024-2025)

- Indoor Turf Field at Schlegel Park ($38M in 2024-2025)

- New Neighbourhood Parks ($1.9M in 2024, $21M overall)

- Urban Forestry ($1.4M in 2024, $11.5M overall)

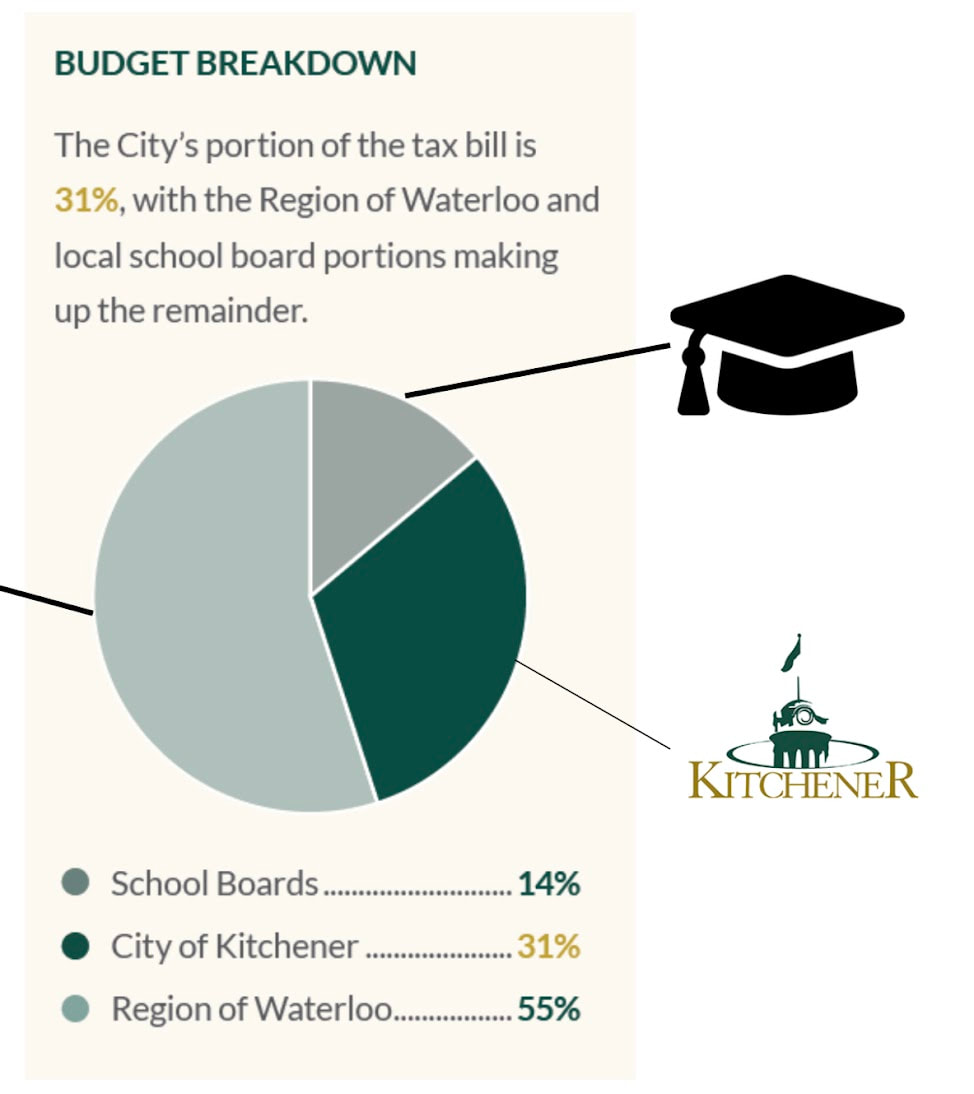

THERE ARE 3 COMPONENTS TO YOUR TAX BILL

Kitchener Collects The Taxes For The City, Region Of Waterloo & School Boards.

Kitchener Passes Those Portion Amounts To The Region & School Board

When You Receive Your Tax Bill Here Is What It Includes

Kitchener Collects The Taxes For The City, Region Of Waterloo & School Boards.

Kitchener Passes Those Portion Amounts To The Region & School Board

When You Receive Your Tax Bill Here Is What It Includes

Municipal Taxes (Kitchener's Share)

Municipal taxes pay for services that make Kitchener a great place to live, work and play.

The tax rate to cover the costs of supplying Kitchener's services is based on city council's adoption of our annual budget. Revenues from provincial grants, user fees and other sources are deducted from the total expenditures.

The final amount needs to be raised through taxation.

Kitchener's portion of your tax bill is 31%

Regional Taxes

These taxes are based on the tax rate adopted by the Region of Waterloo.

This portion is remitted to the Region to support their role in supplying various services including public transit, waste management, policing, housing and shelter and public health and emergency services.

The Region's portion of your tax bill is 55%

Education Taxes

This tax rate is set by the Province of Ontario and remitted to the local school board you support.

The School Board portion of your tax bill is 14%

How Property Assessment and Taxation Works

Watch Short Video HERE

City Of Kitchener's Understanding Your Tax Bill Information HERE

Municipal taxes pay for services that make Kitchener a great place to live, work and play.

The tax rate to cover the costs of supplying Kitchener's services is based on city council's adoption of our annual budget. Revenues from provincial grants, user fees and other sources are deducted from the total expenditures.

The final amount needs to be raised through taxation.

Kitchener's portion of your tax bill is 31%

Regional Taxes

These taxes are based on the tax rate adopted by the Region of Waterloo.

This portion is remitted to the Region to support their role in supplying various services including public transit, waste management, policing, housing and shelter and public health and emergency services.

The Region's portion of your tax bill is 55%

Education Taxes

This tax rate is set by the Province of Ontario and remitted to the local school board you support.

The School Board portion of your tax bill is 14%

How Property Assessment and Taxation Works

Watch Short Video HERE

City Of Kitchener's Understanding Your Tax Bill Information HERE

Thanks for your interest in Kitchener's 2024 Budget.

The draft version of the budget and other information is below.

The provincial government instituted strong mayor powers for Kitchener.

This has changed the way the budget process works. For the details on how, click HERE

Mayor Vrbanovic is committed to working collaboratively council in creating our budget

The draft version of the budget and other information is below.

The provincial government instituted strong mayor powers for Kitchener.

This has changed the way the budget process works. For the details on how, click HERE

Mayor Vrbanovic is committed to working collaboratively council in creating our budget

KEY BUDGET DATES

November 20 - Operating Budget Day 4pm - Meeting Details, Agenda, Watch Live Link HERE

OPERATING BUDGET PRESENTATION BY CHIEF FINANCIAL OFFICER HERE

November 27 - Capital Budget & Public Input Day 1pm - Meeting Details, Agenda, Watch Live Link HERE

CAPITAL BUDGET STAFF PRESENTATION HERE

December 4 - Mayor's Budget Proposal -Meeting Details, Agenda, Watch Live Link HERE

December 14 - Council Votes On Budget Amendments - Meeting Details, Agenda, Watch Live Link HERE

OPERATING BUDGET PRESENTATION BY CHIEF FINANCIAL OFFICER HERE

November 27 - Capital Budget & Public Input Day 1pm - Meeting Details, Agenda, Watch Live Link HERE

CAPITAL BUDGET STAFF PRESENTATION HERE

December 4 - Mayor's Budget Proposal -Meeting Details, Agenda, Watch Live Link HERE

December 14 - Council Votes On Budget Amendments - Meeting Details, Agenda, Watch Live Link HERE

The Draft Version Of Our 2024 Kitchener Budget Has The Following Increases Proposed

Property Taxes: 3.9% or $47 annually or $3.92 Monthly

Water Utility: 4.9% or $21 annually or $1.75 Monthly

Sanitary Sewer Utility: 7.1% or $39 annually or $3.25 Monthly

Stormwater Utility: 7.4% or $17 annually or $1.42 Monthly

All Combined: $124 or $10.34 Monthly

*Increases are based on the average home assessed value of $326,000 and annual water consumption of 170m3.

This is NOT the final budget.

I'd appreciate your input to help Council's work to finalize this budget.

Take Our Budget Allocation Survey HERE

The Consumer Price Index and the Rate Of Inflation

The Consumer Price Index (CPI) is one of the most widely used measures of inflation. There are 8 components in the CPI basket that represent the changes in prices paid by Canadian consumers. Those components are the costs for Food, Shelter, Household Operations, Furnishings & Equipment, Clothing and Footwear, Transportation, Health & Personal Care, Recreation, Education & Reading, and Alcoholic Beverages, Tobacco Products & Cannabis.

City Budget increase percentages are often compared to the rate of inflation. Because the rate of inflation can fluctuate greatly between some years, the City Of Kitchener uses an average rate of inflation percentage from the past 2 years to establish the base rate to judge our budget increases against. To be clear though, much of what the city needs to purchase to run the services we provide for citizens are much different than the 8 components that make up the consumer price index and rate of inflation. Learn about the Consumer Price Index HERE

Property Taxes: 3.9% or $47 annually or $3.92 Monthly

Water Utility: 4.9% or $21 annually or $1.75 Monthly

Sanitary Sewer Utility: 7.1% or $39 annually or $3.25 Monthly

Stormwater Utility: 7.4% or $17 annually or $1.42 Monthly

All Combined: $124 or $10.34 Monthly

*Increases are based on the average home assessed value of $326,000 and annual water consumption of 170m3.

This is NOT the final budget.

I'd appreciate your input to help Council's work to finalize this budget.

Take Our Budget Allocation Survey HERE

The Consumer Price Index and the Rate Of Inflation

The Consumer Price Index (CPI) is one of the most widely used measures of inflation. There are 8 components in the CPI basket that represent the changes in prices paid by Canadian consumers. Those components are the costs for Food, Shelter, Household Operations, Furnishings & Equipment, Clothing and Footwear, Transportation, Health & Personal Care, Recreation, Education & Reading, and Alcoholic Beverages, Tobacco Products & Cannabis.

City Budget increase percentages are often compared to the rate of inflation. Because the rate of inflation can fluctuate greatly between some years, the City Of Kitchener uses an average rate of inflation percentage from the past 2 years to establish the base rate to judge our budget increases against. To be clear though, much of what the city needs to purchase to run the services we provide for citizens are much different than the 8 components that make up the consumer price index and rate of inflation. Learn about the Consumer Price Index HERE

The budget sets the direction and priorities for the work and projects to be completed in 2024.

Our Recent 2023-26 Strategic Plan provides the focus for our budget priorities

Building a Connected City Together

Cultivating a Green City Together

Creating an Economically-Thriving City Together

Fostering a Caring City Together

Stewarding a Better City Together

Investments in Our Community - What Matters To You

Council can allocate 1 Million to be allocated between the options below.

They total 2 Million Dollars but only 1 Million can be allocated.

Some challenging decisions need to be made between these options.

Your input is welcome and helpful. Please do the Survey HERE

The options to consider are below

Support the continued implementation of the City's Housing for All Strategy

Promote more active transportation by improving pedestrian/trail crossings, adding bike parking, and upgrading signs and pavement markings.

Develop an energy strategy to help reduce greenhouse gas emissions.

Replace two additional playgrounds that are at the end of their useful lives.

Simplify and streamline the commercial approval process, making it easier to open a new business in Kitchener.

Support the initial implementation of a new Arts & Culture Master Plan

Develop a Municipal Newcomers Strategy, including community engagement

Create a separated entrance to Cameron Heights pool, allowing for programming during the day.

Review and refresh the City’s Digital Kitchener strategy to continue to improve the lives of people through better use of data and connectivity.

Implement a city-wide data strategy to build organization-wide data practices to deliver better services for residents

Your Input On These Decisions Is Welcome And Valuable. Please Do The Survey HERE

It's important to remember that your tax bill is comprised of 3 portions.

City of Kitchener, Region Of Waterloo and School Boards.

Each set their own budget.

The image below shows the percentage of each contributing portion.

Kitchener Council only controls Kitchener's Budget

A link to the Region Of Waterloo's 2024 Budget information is HERE

City of Kitchener, Region Of Waterloo and School Boards.

Each set their own budget.

The image below shows the percentage of each contributing portion.

Kitchener Council only controls Kitchener's Budget

A link to the Region Of Waterloo's 2024 Budget information is HERE

Click On The Boxes Below For These Specific Budget Sections

You can share your ideas, thoughts, concerns and suggestions for the 2024 Budget

My email is [email protected]

To email all members of council at the same time, use the form located HERE

You can mail council at

Office of the Mayor and Council

Kitchener City Hall

200 King St. W.

Kitchener, ON N2G 4G7

My email is [email protected]

To email all members of council at the same time, use the form located HERE

You can mail council at

Office of the Mayor and Council

Kitchener City Hall

200 King St. W.

Kitchener, ON N2G 4G7

For a Summary Of Past Budgets from 2015 to 2023, click HERE

Helpful Short Videos On Our Budget Processes

Implementing Master, Strategic & Long Term Plans - WATCH HERE

What The City Of Kitchener Provides - What The Region Of Waterloo Provides - WATCH HERE

Using Reserves & Debt Financing - WATCH HERE

Tax Supported and User Supported - The Difference - WATCH HERE

Implementing Master, Strategic & Long Term Plans - WATCH HERE

What The City Of Kitchener Provides - What The Region Of Waterloo Provides - WATCH HERE

Using Reserves & Debt Financing - WATCH HERE

Tax Supported and User Supported - The Difference - WATCH HERE